See our report for December of 2021 here 👇

How Did the Columbus Ohio Real Estate Market Perform in December 2020?

How did the real estate market perform here in Columbus? We did the research! Find out below. 👇

If you have any questions, you can contact us via the contact form below | Call us at 614-596-2934 | email us at [email protected] | or contact us via FB Messenger

Welcome to our Columbus real estate market update for December of 2020. Each month, we analyze the sales data on how the real estate market here performed during the last month. Then, we put the data into a readable and easily understandable format for both our clients and the general public.

If you have any questions about the data in this month’s report, please don’t hesitate to reach out to us. We are always happy to help. You can find our contact information at the bottom of this page.

Table of Contents

The 2020 Columbus Ohio real estate market was unexpectedly turbulent towards the end of the first quarter due to the pandemic that spread across the country. As the first wave of COVID-19 hit in the spring, housing market activity slowed substantially before staging a dramatic comeback just a couple of months later.

Buyer activity was the leader again in 2020. With mortgage interest rates setting record lows multiple times throughout the year and a strong drive by many buyers to secure a better housing situation – in part due to the new realities brought on by COVID-19 – many segments of the market experienced a multiple-offer frenzy not seen in the last 15 years or more.

While markedly improved from their COVID-19 spring lows, seller activity continued to lag buyer demand, which had strengthened the ongoing seller’s market for most housing segments as inventories remain at record lows.

The Columbus Ohio real estate market in 2020 proved to be incredibly resilient, ending the year on a high note. Home sales and prices were higher than in 2019 across most market segments and across most of the country. Seller activity recovered significantly from the COVID-19 spring decline, but overall activity was still insufficient to build up the supply of homes for sale.

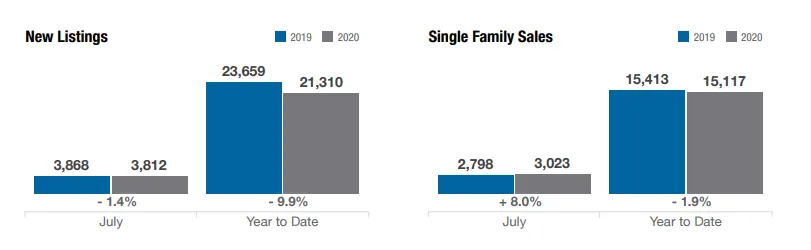

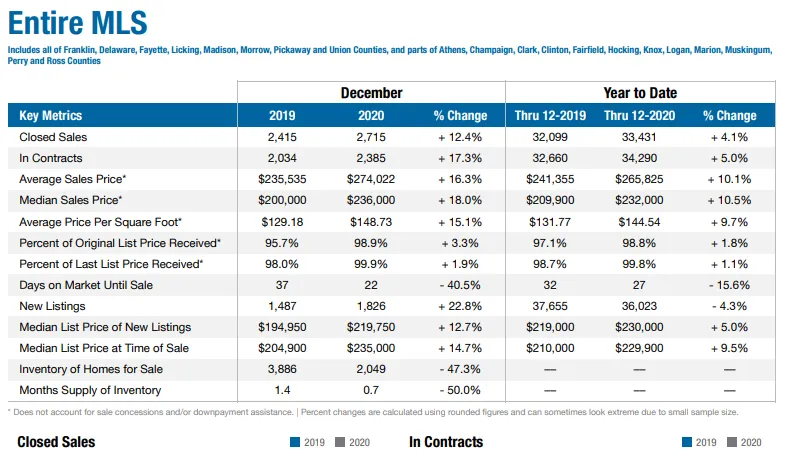

Sales: Home sales increased 4.1 percent in 2020 to 33,431, usurping the previous record of 32,218 in 2017 by 3.8 percent.

Single-family home sales increased 4.2 percent last year while condominium sales were up 3.4 percent.

Condos held on to its market share of just under 15 percent of sales and single-family homes made up the lion’s share of 2020 sales at just over 85 percent, also unchanged from 2019.

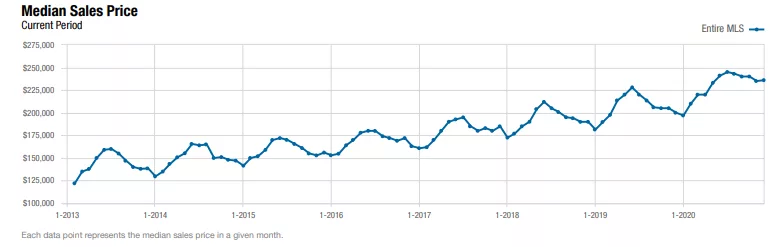

Prices: Strong demand in the Columbus Ohio real estate market and lack of supply worked to push home prices up in 2020. The overall median sales price increased 10.5 percent to $232,000 for the year. Single-family home prices were up 10.5 percent compared to last year, and condo home prices were up 8.3 percent.

In the central Ohio area, Columbus REALTORS® has established the affordable housing benchmark as $180,000 based on median income, typical family size, interest rates and qualifying ratios. This would, of course, include most first-time home buyers.

Homes under $180,000 made up 33 percent of the market share in 2020, a decrease of 17.5 percent, while homes over $180,000 gained 11.7 percent market share.

Demand for entry-level homes were very high in 2020, but sales were down simply because of the lack of inventory for homes under the $180,000 price point. Fewer home sales at the entry-level and increased sales at higher price-points combined to push the average sale price in 2020. In many ways, the $200,000 homes was the 2020 version of a $180,000 home in this Columbus, Ohio real estate market.

List Price Received: Sellers received, on average, 99.8 percent of their list price at sale, up 1.1 percent from 2019. Due to the declining inventory in the last half of the year, the average sale price exceeded the list price in five of the last six months.

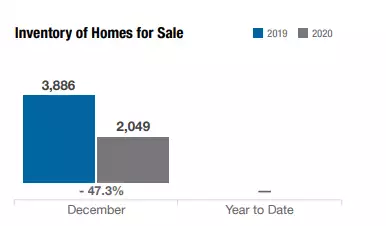

Inventory: New listings decreased by 4.3 percent to finish the year at 36,023. Other than seven months in late 2018 and early 2019, central Ohio has experienced year over year declines in inventory for nearly ten years.

There were 2,049 active listings at the end of 2020, which was 47.3 percent less than the previous year. Five years ago, there were just over 6,000 listings at the end of the year, and ten years ago, that number was up to 16,000.

Months Supply: Reduced inventory and strong demand resulted in a 0.7 months supply at the close of 2020. This means that, if no more inventory were added to the market, it would take about three weeks to sell all listed homes based on the current sales pace – yet another record low for central Ohio.

Lender-Mediated Properties: The foreclosure market continued to remain a small player in the overall market amid numerous forbearance efforts undertaken by the government and lenders. In 2020, the percentage of closed sales that were either foreclosure or short sale decreased by 27.0 percent to end the year at 1.8 percent of the market. Foreclosure and short sale activity may tick higher in 2021 as forbearances expire with some homeowners unable to meet their obligations.

As we look to 2021, signals suggest buyer demand will remain elevated and tight inventory will continue to invite multiple offers and higher prices across much of the housing inventory.

Mortgage rates are expected to remain low, helping buyers manage some of the increases in home prices and keep them motivated to lock in their housing costs for the long term. These factors will provide substantial tailwinds for the housing market into the new year.

With more people working from home, the demand for more space and different types of space has increased notably.

If you have concerns about listing your home in the current market, I invite you to consider the following: the current low-interest rates will enable you to afford more home. Further, if you are discouraged by the limited options, new construction is an excellent option to consider. This because there are currently many new developments that can offer the type of space that meets your needs.

Central Ohio Homes for Sale & Listings

🏘 There were 3,886 homes for sale in 2021 🏘

The Average Price per Square Foot in Columbus

💲 The Average Price per square foot in December 2020 was $148.73, up 15.1% from the same time last year

💲 This price is nearly $20 per square feet more expensive compared to the same time last year 💲

Columbus, Ohio: Days on Market

🏡 The average real estate listing stayed on the market for just 22 days in December 2020 🏡

🏡 For reference, this number was 37 days in December 2019 🏡

💲 Columbus Ohio Home Prices 💲

💲 The average sale price for these listings was $274,022 (up 16.3% from last year)

💲 The median sale price for these listings was $236,000 (up 18% from last year)

See the graph below to see how the median sale price has changed, year over year, since 2013 in Columbus 👇

Closed Home Sales vs Homes in Contract in Columbus

New Listings & Single Family Sales in Columbus

Percentage of Original List Price Received

This graph represents what percentage of homes sell for their original list prie

Condo Sales in Central Ohio

The Columbus, OH Real Estate Market in December: At a Glance

Home sales were up 12.4% in December of this year in Columbus compared to the same period last year.

Further, the average sale price, median sale price, and the percentage of people receiving their expected price for their homes during a sale have all increased since last year. By all measures, the Columbus real estate market in December was red hot.

How to Sell Your Home Safely in Columbus

If you are planning to sell your home in Columbus, Ohio this year, we recommend watching this short video here, which has some quick tips for selling your home safely in 2021

How to Buy a Home in Columbus

Click the link below to get our buyer’s guide on how to buy your home in Columbus by getting mortgage ready

Any Questions?

Contact Us

If you have any questions, you can contact us via the contact form below | Call us at 614-596-2934 | email us at [email protected] | or contact us via FB Messenger

We’ll be happy to be of service.