Any Questions?

Contact Us

If you have any questions, you can contact us via the contact form below | Call us at 614-596-2934 | email us at [email protected] | or contact us via FB Messenger

We’ll be happy to be of service.

How did the real estate market perform here in Columbus? We did the research! Find out below. 👇

If you have any questions, you can contact us via the contact form below | Call us at 614-596-2934 | email us at [email protected] | or contact us via FB Messenger

Welcome to our Columbus real estate market update for May of 2022. Each month, we analyze the sales data on how the real estate market here performed during the last month. Then, we put the data into a readable and easily understandable format for both our clients and the general public.

If you have any questions about the data in this month’s report, please don’t hesitate to reach out to us. We are always happy to help. You can find our contact information at the bottom of this page.

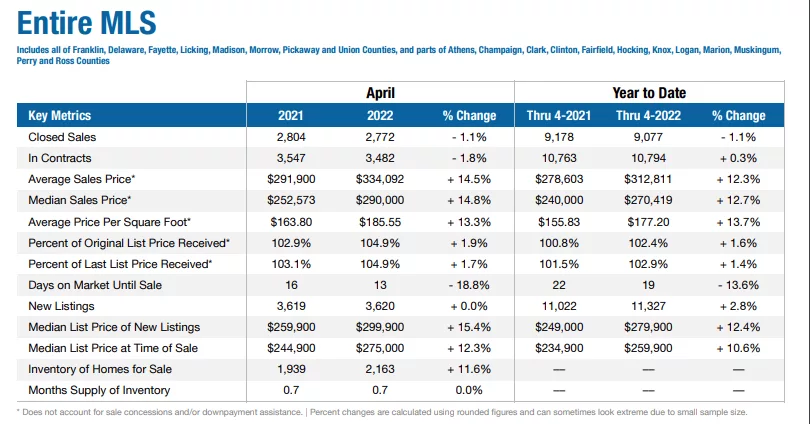

Rising interest rates, lack of available homes and a decade of underbuilding are taking their toll on central Ohio housing activity as home sales have slowed in 2022 compared to the record-breaking pace set in 2021.

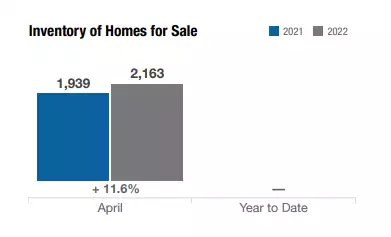

Thus far in 2002 (January through April), buyers are purchasing 80 percent of the homes available, down from 83.2 percent in 2021, leaving inventory 11.6 percent higher than last spring, but still well short of the inventory we need to meet the demand of our growing region.

The average 30-year fixed rate for a mortgage is now over five percent, up from just over three percent late last year and the highest since 2009.

“Even though we have more homes for sale today than a year ago, rising interest rates are preventing some buyers from making a move right now,” said Sue Van Woerkom, 2022 president of Columbus REALTORS®.

“For every one percent increase in interest rates, your buying power decreases by about 10-11 percent. And this is especially challenging for first-time home buyers.”

The average age of a first-time home buyer in central Ohio today is 31 years old and they purchase 38 percent of the homes sold.

Statewide, first-time buyers today tend to be 35 years old and represent 37 percent of Ohio sales, Nationally, this home buying segment is 33 years old, purchasing 34 percent of the homes sold.

The median price of a home sold in central Ohio this year ($270,419) marks a 12.7 percent gain compared to the price of homes sold during the first four months of 2021.

The median price a first-time home buyer is paying in central Ohio is around $218,000.

“Central Ohio is a top metro area for young professionals,” adds Van Woerkom. “Almost 16 percent of our population is age 25-34 and are, or will be, looking to purchase a home.”

“To accommodate them, we need more home owners to become home sellers. Moving up – or transitioning to another type of living style such as a low maintenance home – is how we help get our first-time buyers into homes and on the first rung of the ladder to economic wealth building.”

🏘 There were 2,163 homes for sale in May 2022 🏘

💲 The Average Price per square foot in April 2022 was $185.55 💲

💲 This price is 13,3% more expensive compared to the same time last year 💲

🏡 The average real estate listing stayed on the market for just 13 days in April 2022 🏡

💲 The average sale price for these listings was $334,092 (up 14.5% from last year)

💲 The median sale price for these listings was $290,000 (up 14.8% from last year)

See the graph below to see how the median sale price has changed, year over year, since 2013 in Columbus 👇

This graph represents what percentage of homes sell for their original list prie

Home sales are up 5.8% this year in Columbus compared to the same period last year.

Further, the average sale price, median sale price, and the percentage of people receiving their expected price for their homes during a sale have all increased since last year. By all measures, the Columbus real estate market in September of 2021 has continued its “hot streak.” It will be worth paying significant attention to see the long term effects such a (relatively) long hot streak might have.

If you are planning to sell your home in Columbus, Ohio this year, we recommend watching this short video here, which has some quick tips for selling your home safely in 2021.

Click the link below to get our buyer’s guide on how to buy your home in Columbus by getting mortgage ready

Contact Us

If you have any questions, you can contact us via the contact form below | Call us at 614-596-2934 | email us at [email protected] | or contact us via FB Messenger

We’ll be happy to be of service.

1560 Fishinger Road Columbus, Ohio 43221 Suite #150

Van Steyn Partners | REMAX Premier Choice

Check out my Redfin Partner Agent reviews here.